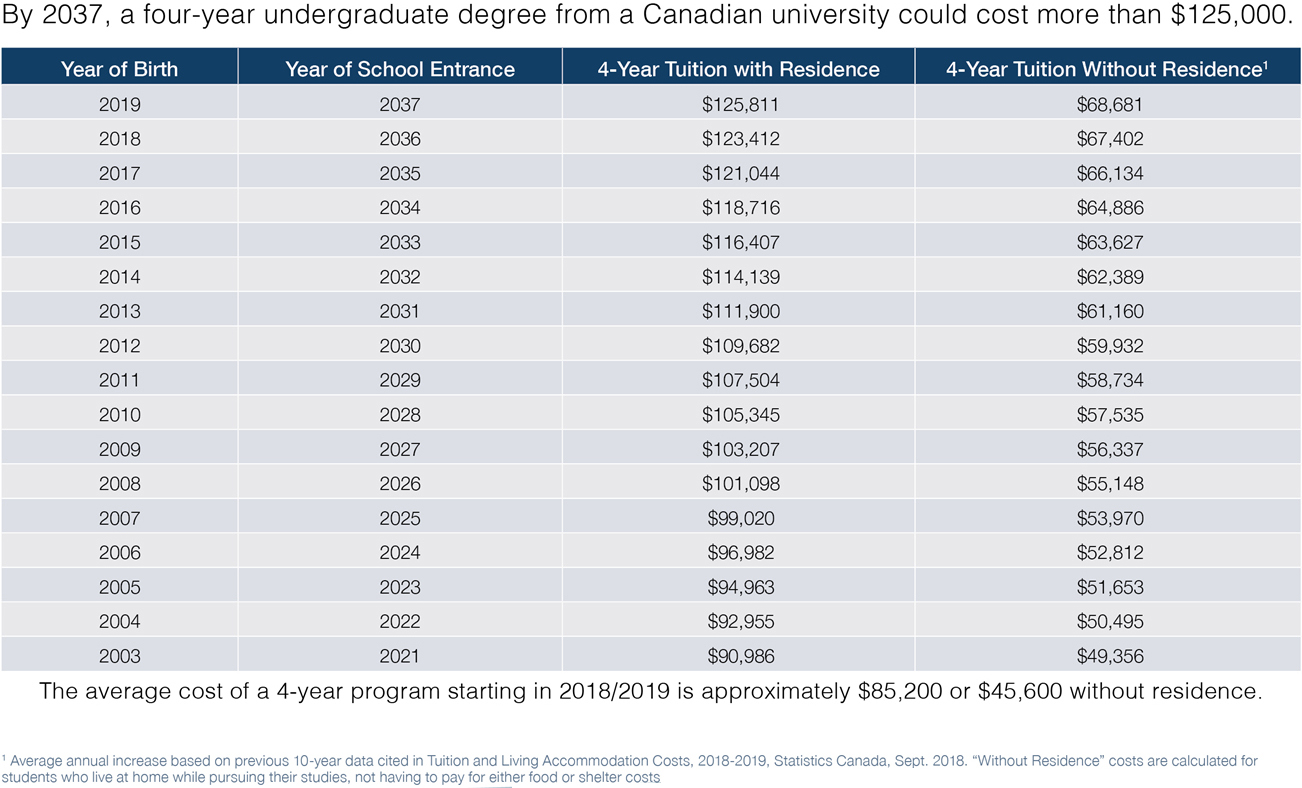

As we all know that Canada is one of the best countries for kids’ education and have the world class Universities and colleges. Also, we know that the school education is fully funded either on the Public-School Board or the catholic School Board across Canada. However, the post-secondary education cost must be borne by the student or their Parents & guardians. Therefore, planning is very essential. Let us look at the projected cost of future education, the chart below is self-explanatory:-

As we look at different type of program, we see that there are a substantial different and these costs may vary from the various country from which we may have immigrated to Canada. Therefore, understanding and planning for it according to the cost of Canadian University or college is very important.

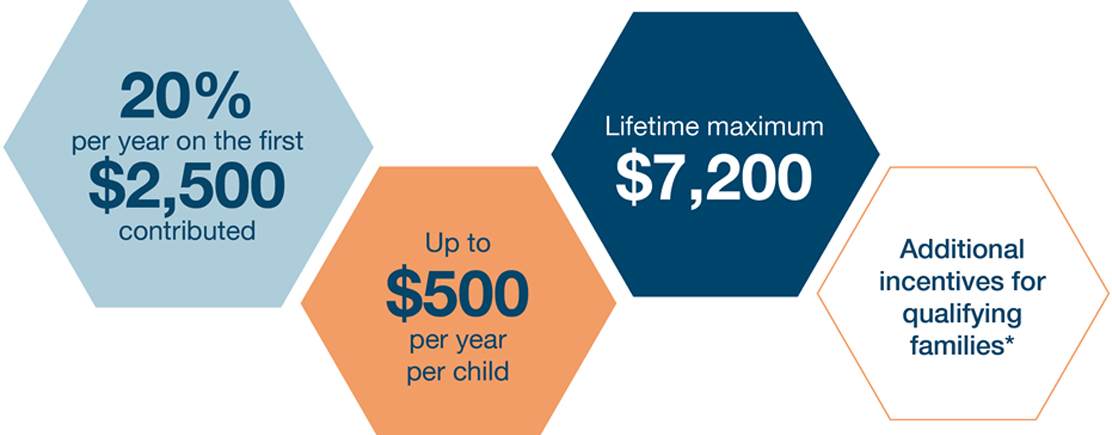

As the Government understand that these are big cost and the average Canadian Family to shoulder all by themself is very difficult, and in order to give a helping hand and help with shouldering the weight to some extend by providing some funding, the Government of Canada introduced the Education Saving Grant in 1998 and improved over the years and here are the current forms of support and the following Chart explains the same.

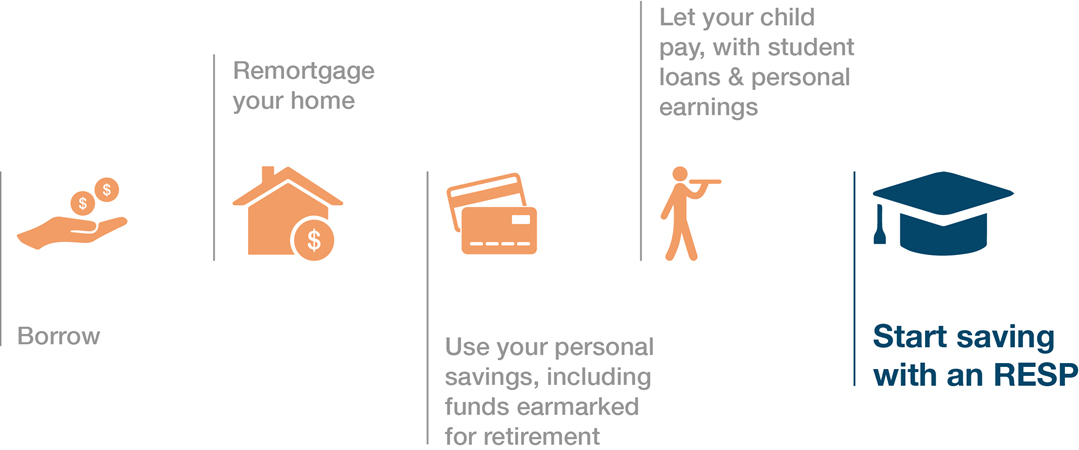

As a Responsible Parent, one should be prudent in their planning and should look for the best options, as a financial professional we say that these are some of the option as Parent that you have when your Child is at the age of 18 ready to enter into the college or University or any post-Secondary studies.

At Goldmax we wish the best for your child and your family, and as we have access to most of the service providers in Canada we could bring the best for your family, all you need to do is to reach out to us and set up an appointment with one of our Licensed professional to discuss the need and find the solution based on your situation and need.