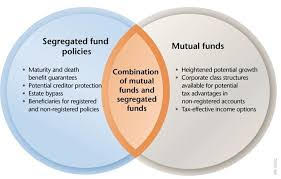

Segregated funds are very similar to Mutual Funds, which is a concept, which holds investment.

As many have a misconception that Mutual Funds are investments, in fact it holds investments, basically that when a Mutual Fund company decided to create a particular Fund, the 1st step is to create the Profile of the fund and then it is given to a Portfolio Manager or a team, who will then put the profile plan into action by selecting the company based on the profile and invest money into those companies shares, based on those companies performance the funds make money.

When an Insurance company wish to introduce a New Segregated fund, they look for a Mutual for the kind of Fund they are looking for and then they get that Mutual Fund and make it as the segregated Fund. Neither the Profile nor the Fund manager changes, and therefore the funds performance also will not change.

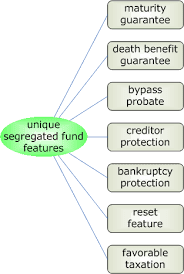

In my view having a Segregated Fund one has many advantages as shown below and One disadvantage which is it has a higher MER, which will vary depends on the Guarantee that you look for.

In my opinion its always worth investing in a Segregated Fund than investing in Mutual Fund.